UM-Flint accounting students dedicate expertise to assisting low-income individuals with tax returns

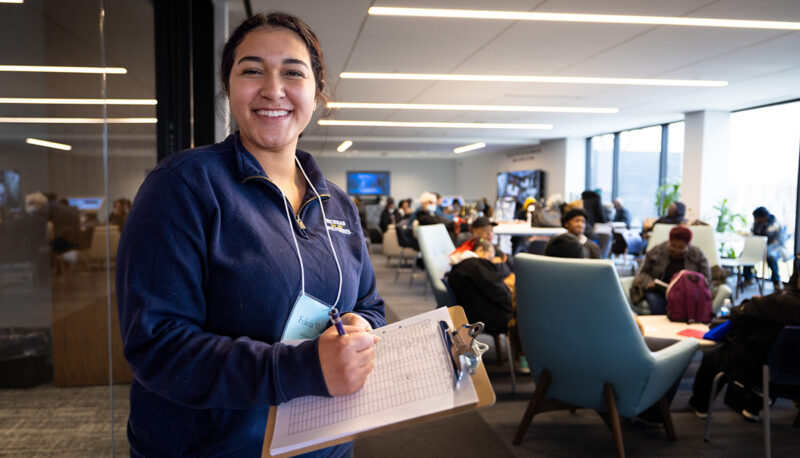

As part of a longstanding commitment to community engagement, accounting students from the University of Michigan-Flint's Income Tax Preparation classes are actively involved in a program aimed at aiding low-income individuals in preparing their tax returns.

The impactful initiative, known as the Volunteer Income Tax Assistance or VITA, is now celebrating its 40th anniversary and highlights the enduring dedication of the university's students to make a positive difference in the lives of those in need.

For four decades, aspiring accountants from UM-Flint's School of Management have devoted their skills and knowledge to assisting local community members in navigating the complexities of tax preparation. This community-based program has become a staple in the university's commitment to fostering social responsibility and creating a positive impact beyond the campus borders.

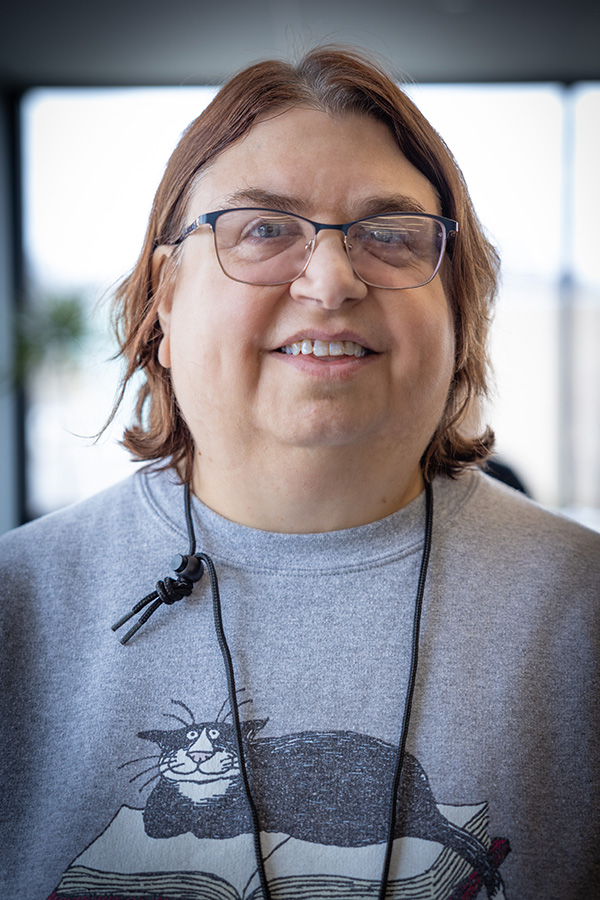

"It's a wonderful situation for the students and the community," said Cathleen Miller, associate professor of accounting at SOM and one of the program's first student participants in 1984. "Our students can gain incredibly valuable real-world experience while community members can gain access to a vital service, free of charge."

VITA, an Internal Revenue Service-recognized program, allows participating students to gain valuable hands-on experience, enhance their skills, and learn tax law and a tax software program.

However, the program's impact extends beyond the immediate assistance with tax returns. Students involved enhance their practical understanding of tax regulations and interpersonal skills through direct interaction with clients.

"Learning those soft skills, such as communication with clients in how to ask the right types of questions to resolve a given situation, communication with supervisors, and communication as a team as they work with each other to complete tax returns quickly and accurately, are hugely important," said Miller who has supervised the program since 1998.

This year's service began Feb. 10 at the Gloria Coles Flint Public Library, 1026 E Kearsley St, Flint, and will occur on a first-come, first-served basis, 9 a.m. to 5 p.m., every Saturday through the end of March. A typical Saturday will see students work with up to 50-70 filers during the eight-hour window.

Before working with community members on their returns, student preparers participate in a four-day training session to learn laws applicable to city, state, and federal returns and gain insight into working with the IRS-provided Tax Slayer computer program. After their training session, students take one exam to review each return type to become certified in the filing process.

"We're pretty consistent in working with approximately 400 filers yearly," said Miller. "And our students have established such a good rapport with the community that we see a lot of repeat customers in addition to those that are new to the service."

Community members wishing to take advantage of the free service must earn less than $65,000 and not be self-employed. Filers must provide proof of identity, such as a driver's license or other government-issued ID, a social security card, proof of income, and proof of expenses if they are itemizing. "They'll also need to share with the preparers if they own or rent their home, and, if they own, what their property taxes are, so bringing copies of their 2023 winter and summer property tax bills is very helpful," Miller said.

This service is invaluable for those who may not have the financial means to hire professional tax assistance, ensuring they meet their obligations while maximizing their eligible returns.

"Being able to interact with the taxpayers and help them during a time of need as we perform community service is what makes it special for me to participate," said Michelle Chen, a 2021 UM-Flint graduate with a bachelor's degree in accounting. "That's why, even after graduating, I decided to continue helping. The interaction and seeing that those who come to us aren't just numbers, but people you can make a difference for – and are so grateful for your help – is nice."

Miller, who will be on-site during each Saturday session to work alongside her 15 student volunteers, said that in addition to their time at the FPL, the group will also conduct two sessions on the UM-Flint campus, beginning at 9 a.m., March 30 and April 1, at the university's School of Management, inside the Riverfront Conference Center, 1 Riverfront Plaza, Flint.

Related Posts

No related photos.

Robb King

Robb King is the director of marketing and communications at UM-Flint. He can be reached at [email protected].